Saturday, September 20, 2008

A Few Good Ones...

After Morgan Stanley lost 39 percent of its value in one week, Bloomberg reported that Sen. Hillary Clinton urged the U.S. Securities and Exchange Commission to ban the short-sale of Wall Street brokerages to stop panic sell-offs.

Well, lo and behold, a few days later, the SEC followed Clinton's advice according to The Wall Street Journal.

Meanwhile, presidential candidates Barack Obama and John McCain have been missing in action with their deafening silence on what to do. Ditto for Nancy and Harry. Fortunately though, there is a guy with some balls in Congress.

House Financial Services Committee Chairman Barney Frank (D-Mass.) is quickly moving a bill through Congress that would "authorize purchases of up to $700 billion in mortgage-related assets at any given time and giving the department sweeping authority for at least two years to carry out the enterprise.

Yikes! Seven hundred billion is an awful lot of $$$ and future red ink. And speaking of red, there goes that little red bike for Xmas we had hoped to give to our grandkids in the future.

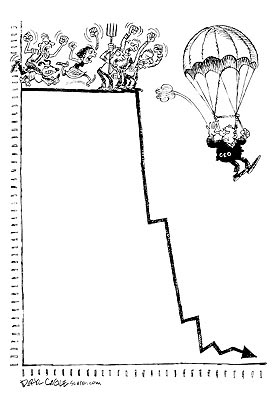

Included in the Dem proposal is relief for homeowners with "foreclosure-relief languag e" and language that "impose[s] compensation limits on Wall Street executives." No golden parachute for executives; this is a Dem bill, after all.

e" and language that "impose[s] compensation limits on Wall Street executives." No golden parachute for executives; this is a Dem bill, after all.

Treasury Secretary Henry Paulson is resisting any restrain on executive perks, of course. But one good question to ask Mr. Paulson is why in God's green little acre should executives be paid for miserably failing while taxpayers are left footing the bill of their incompetence?? Nah, let them enjoy the fruits of their mismanagement by joining the same unemployment line as other Bush cronies.

One final honorable note: President Herbert Hoover, er, George Bush has been silent on the economic import of the mortgage meltdown as well.

Well, lo and behold, a few days later, the SEC followed Clinton's advice according to The Wall Street Journal.

Meanwhile, presidential candidates Barack Obama and John McCain have been missing in action with their deafening silence on what to do. Ditto for Nancy and Harry. Fortunately though, there is a guy with some balls in Congress.

House Financial Services Committee Chairman Barney Frank (D-Mass.) is quickly moving a bill through Congress that would "authorize purchases of up to $700 billion in mortgage-related assets at any given time and giving the department sweeping authority for at least two years to carry out the enterprise.

Yikes! Seven hundred billion is an awful lot of $$$ and future red ink. And speaking of red, there goes that little red bike for Xmas we had hoped to give to our grandkids in the future.

Included in the Dem proposal is relief for homeowners with "foreclosure-relief languag

e" and language that "impose[s] compensation limits on Wall Street executives." No golden parachute for executives; this is a Dem bill, after all.

e" and language that "impose[s] compensation limits on Wall Street executives." No golden parachute for executives; this is a Dem bill, after all.Treasury Secretary Henry Paulson is resisting any restrain on executive perks, of course. But one good question to ask Mr. Paulson is why in God's green little acre should executives be paid for miserably failing while taxpayers are left footing the bill of their incompetence?? Nah, let them enjoy the fruits of their mismanagement by joining the same unemployment line as other Bush cronies.

One final honorable note: President Herbert Hoover, er, George Bush has been silent on the economic import of the mortgage meltdown as well.